While policymakers set ambitious climate goals and innovators develop breakthrough solutions, the critical missing piece remains capital deployment at scale.

First-of-a-Kind (FOAK) commercial projects—those that prove a technology works outside a demonstration plant or lab – face the toughest funding barriers.

This is a challenge that many of our Finalists face in their scaling journey; capital needs are massive, tech risks remain high, and investors hesitate without clear commercial proof points.

To explore practical ways that we can de-risk FOAK deployments and unlock financial pathways to scale, The Earthshot Prize and Herbert Smith Freehills brought together investors, corporates, and finance experts for a deep dive into what’s actually working to get these technologies over the line.

Earthshot Prize Finalists ATS, 44.01, and LanzaTech shared what it really takes to finance FOAK projects, what’s still missing, and how to move from demonstration to commercial scale.

—

Here are some key takeaways from the discussions.

Companies developing world-changing decarbonisation solutions – whether turning industrial waste heat into electricity (ATS), transforming captured carbon into usable products (LanzaTech), or permanently removing CO₂ through mineralisation (44.01) – all face (or in Lanzatech’s case, have faced) a common challenge: investors hesitate to back capital-intensive projects without proof that the technology is viable at scale and can generate commercial returns.

In the absence of the early financial backing and catalytic capital, these critical technologies – essential for reducing carbon emissions and reaching net zero goals – struggle to achieve their promise.

Procurement cycles with large industrial buyers can take years, and long-term offtake agreements (critical for project bankability) are hard to secure beyond 5-7 years – far shorter than what’s needed to finance expensive, asset heavy, infrastructure-scale decarbonisation projects (15-20 years).

The best solutions will struggle to scale without rethinking financing models. Catalytic capital and structured financing that absorbs early-stage risk—can unlock private investment. This includes:

Policy consistency is vital for a stable financing architecture. While incentives such as the EU Green Deal are helpful, sudden shifts in regulation (including ESG backlash) can disrupt investment flows. Investors are now taking a more pragmatic approach – prioritising commercially viable technologies over subsidy-dependent models.

Regional regulatory variations create additional complexity for companies trying to scale internationally.

2024 Earthshot Prize Winner, ATS, has developed scalable technology to capture waste heat from heavy industry

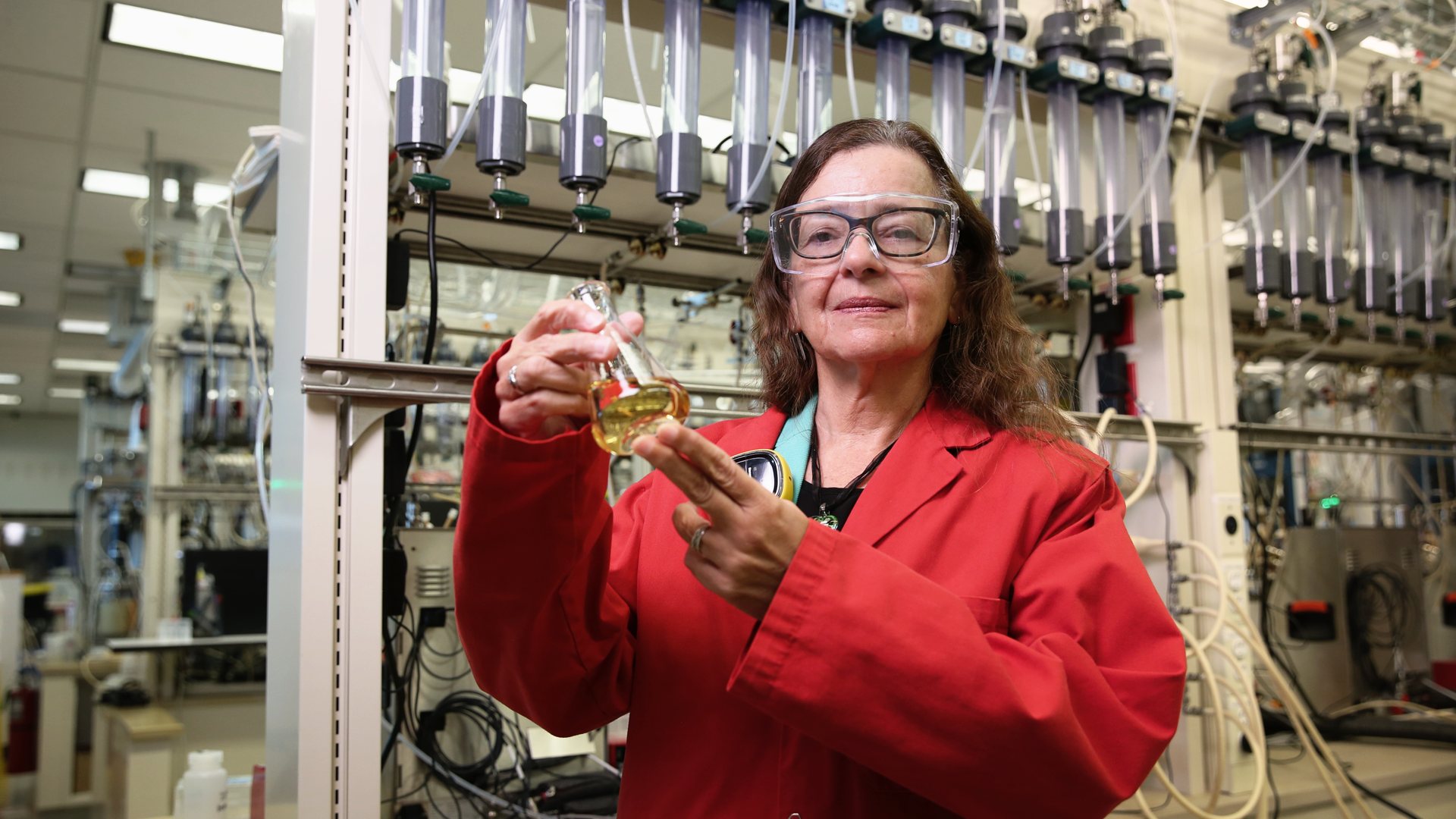

Jennifer Holgrem, CEO of 2022 Earthshot Prize Finalist LanzaTech, who use bacteria to recycle carbon pollution into profitable and sustainable products

Talal Hasan from 2022 Earthshot Prize Winner, 44.01, who remove CO2 permanently by mineralising it in peridotite rock

The message from this roundtable was clear: we don’t need perfection – we need action.

Governments, corporates, and financial institutions must work together to create the conditions for scalable decarbonisation.

Startups must position themselves for investment early on by:

Investors need to adapt their risk models

Corporates must play a bigger role. Industrial partnerships and corporate venture capital (CVC) involvement can accelerate deployment by:

Policy must provide market stability and clarity

Decarbonisation is not optional and won’t happen in theory, it requires real capital, real deals, and real urgency.

We don’t need perfection, we need action. “Good enough” solutions must scale now, or we risk missing global climate targets.

—

Discover more about The Earthshot Prize Finalists working to decarbonise at scale.